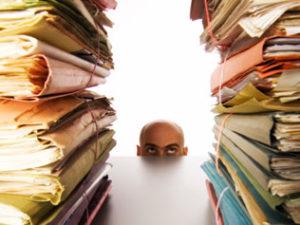

Can you believe it’s almost June? Where has this year gone? As the end of May approaches we thought we’d better start throwing some ideas together to help Liverpool residents prepare for the silly season ahead. Of course we’re not speaking of Christmas in July or the approaching winter holidays, we’re talking about the mid-year event that has grown men and women everywhere turning their houses upside down in search of that elusive receipt required for a deduction – Oh yes, it’s tax time!

Can you believe it’s almost June? Where has this year gone? As the end of May approaches we thought we’d better start throwing some ideas together to help Liverpool residents prepare for the silly season ahead. Of course we’re not speaking of Christmas in July or the approaching winter holidays, we’re talking about the mid-year event that has grown men and women everywhere turning their houses upside down in search of that elusive receipt required for a deduction – Oh yes, it’s tax time!

Naturally, if you’re one of the few who keeps detailed records of all income and expenditures, log books for vehicles, and neatly files all paperwork and receipts away, you’re likely to see tax time as nothing more than a slight hiccup to your usual well organised week. However, if you’re like most of the population, you’re likely to be in need of a little help getting yourself tax ready before the end of June. Here are a few tips to get you started:

- Clarify exactly what you can claim as expenses. You may need to speak with an expert to establish this if you’re unsure, as there are all sorts of things that can qualify as a deduction in particular circumstances. Deductions are typically related to expenses you have for doing your job, such as home office expenses, phone expenses, costs of equipment, and travel. Those who run their own business from home are likely to have many expenses that can be claimed. Missing out on a deduction (or the annual depreciation of an expense) can cost you, so get educated and make sure you’re aware of all the relevant claims you can make.

- Collect all documents showing the income you’ve received over the last financial year. These may include payslips, Centrelink documents, statements of dividends or investment returns, and bank statements detailing interest you’ve earned over the year.

- Collect documents that show evidence of what you’re claiming as a tax-deductible expense. These may be health related recepts, health insurance statements, work and/or study expenses, and receipts for any donations you’ve made to charities.

- If you’ve bought or sold Liverpool real estate in the past year, or have purchased or sold any other asset subject to capital gains tax (such as shares), make sure you include records of the sale/purchase (with dates).

Whether you’re planning to lodge your assessment yourself or use a registered tax agent or Liverpool accountant, it’s a good idea to start thinking ahead and begin collating all the required information. This will certainly lessen the headache in front of you as we head towards the end of June.

Will you be completing your own return, or do you rely on the advice of experts at tax time?